News

Delhi High Court refers patent case against Google's Gemini and Android to mediation

The Delhi High Court on Friday referred to mediation a patent infringement case filed by a tech company Voicemonk against Google LLC and its group entities for infringing two Indian patents [Voicemonk Inc v. Google LLC & Ors].

Read more at:

https://bit.ly/lexportvmbb

Delhi HC refers Voicemonk’s patent case against Google’s Gemini, Android to mediation

New Delhi: The Delhi High Court on Friday referred to mediation a patent infringement case filed by Voicemonk Inc against Google LLC and its group companies.

HC refers Voicemonk's patent infringement case against Google to mediation

NEW DELHI – The Delhi High Court Friday referred Voicemonk Inc.'s patent infringement suit against Google LLC. and its group entities to mediation. Voicemonk has accused Google of infringing its patents relating to the display of search results on one page and learning about user behaviour across mobile phone applications to recommend future actions.

read more at:

https://bit.ly/lexportvmim

Delhi High Court Refers Voicemonk-Google Patent Dispute to Mediation, Voicemonk Inc. v. Google LLC & Ors. [Decision dated February 06, 2026]

The Delhi High Court has referred a commercial patent infringement suit filed by US-based technology company Voicemonk Inc. against Google LLC and its group entities to mediation, after Google informed the Court that it was willing to explore an amicable settlement.

read more at:

https://bit.ly/lexportvmtbb

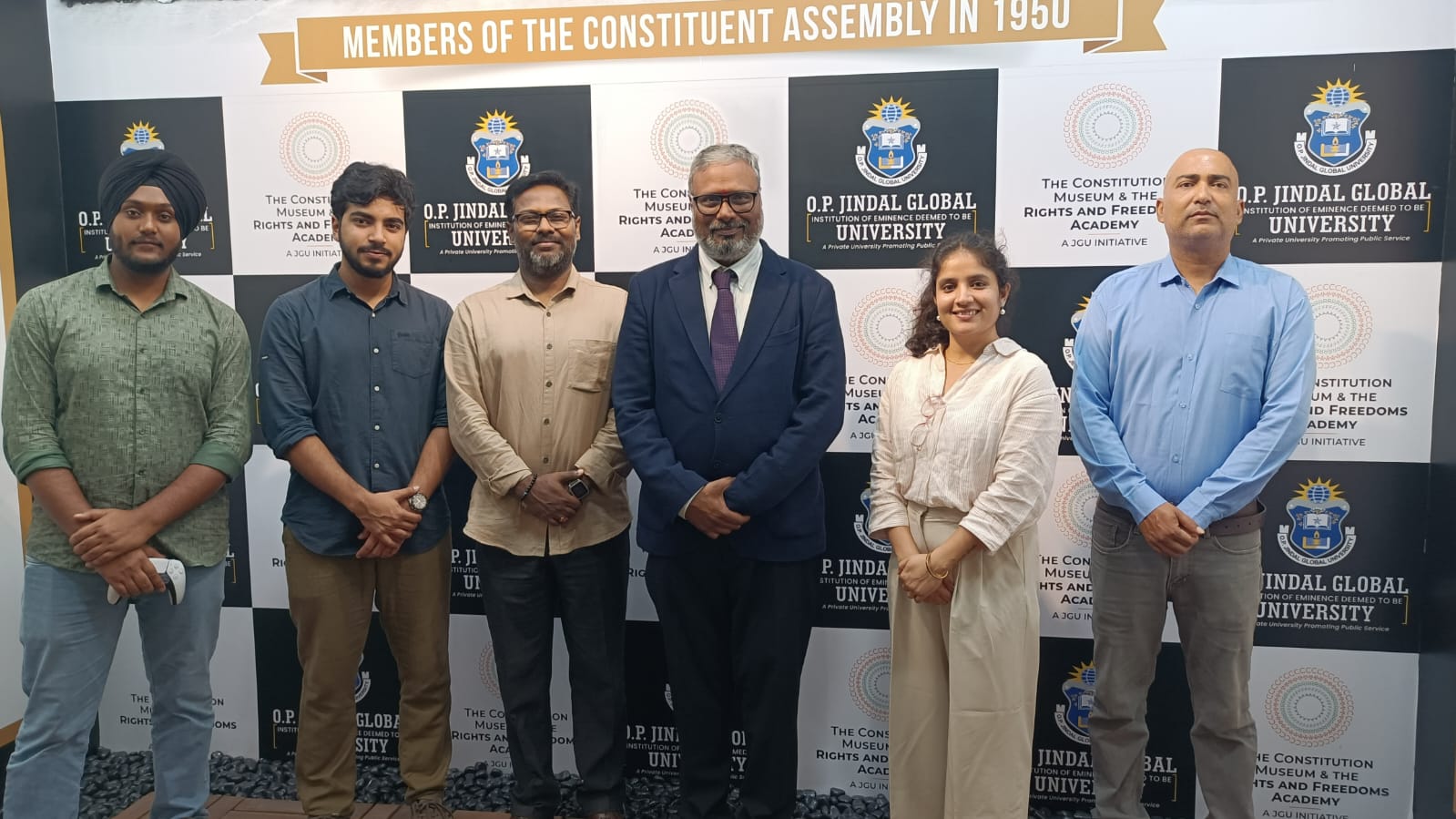

Memorandum of Understanding (MoU) Signing Ceremony

Jindal Global Law School (JGLS) and Lexport entered into a Memorandum of Understanding (MoU) on August 27, 2025, at the JGLS campus, Sonipat.

The MoU was formally signed by Mr. Srinivas Kotni, Founder and Managing Partner of Lexport, and Prof. Gaurav Shukla, representing Jindal Global Law School.